JC Clark

Investing

Rain or shine, we weather all market conditions with confidence.

-

Value Investing

“Unconventional behavior is the only road to superior investment results, but it isn’t for everyone”- Howard Marks

We apply a rigorous fundamentally-driven investment process to under-followed companies and out of favour segments of the market.

We believe in investing with a long-term focus and in only a small group of high quality businesses.

We focus on businesses that generate significant free cash flow, operate in industries with high barriers to entry, and have the ability to compound capital at above average rates of return over the long term.

Before committing capital to a new investment, our team seeks a large margin of safety and attempts to purchase each business at a material discount to its intrinsic value.

-

Preservation of Capital

“You must force yourself to consider opposing arguments. Especially when they challenge your best loved ideas”- Charlie Munger

Independent thinking and a healthy dose of skepticism are key to avoiding the big investing pitfalls.

JC Clark’s value investing approach has consistently provided clients downside protection during the most challenging market environments. A keen focus on risk management, active hedging, and the ability to hold cash have allowed us to mitigate risk during periods of market turmoil. Preservation of our clients’ capital is paramount in our investment approach.

-

Investment Strategies

JC Clark’s investment strategies are designed to grow and preserve capital across a wide variety of market environments. We create a customized asset allocation plan for each client based on individual goals and allocate capital across a range of equity, credit, and alternative strategies.

Equity Strategies

- JC Clark US Equity Fund

CloseUS Equity strategy with a fundamentally driven value investing approach.

Credit Strategies

- JC Clark Yield Trust

CloseFixed Income strategy with a focus on Canadian and US corporate bonds.

Alternative Strategies

- JC Clark Preservation Trust

CloseNorth American Long/Short Equity strategy with moderate market exposure and a focus on preservation of capital.

- JC Clark Opportunity Trust

CloseEvent driven North American Long/Short Equity strategy with a focus on special situation opportunities.

- JC Clark US Equity Fund

-

Results

“The intelligent investor is a realist who sells to optimists and buys from pessimists”- Benjamin Graham

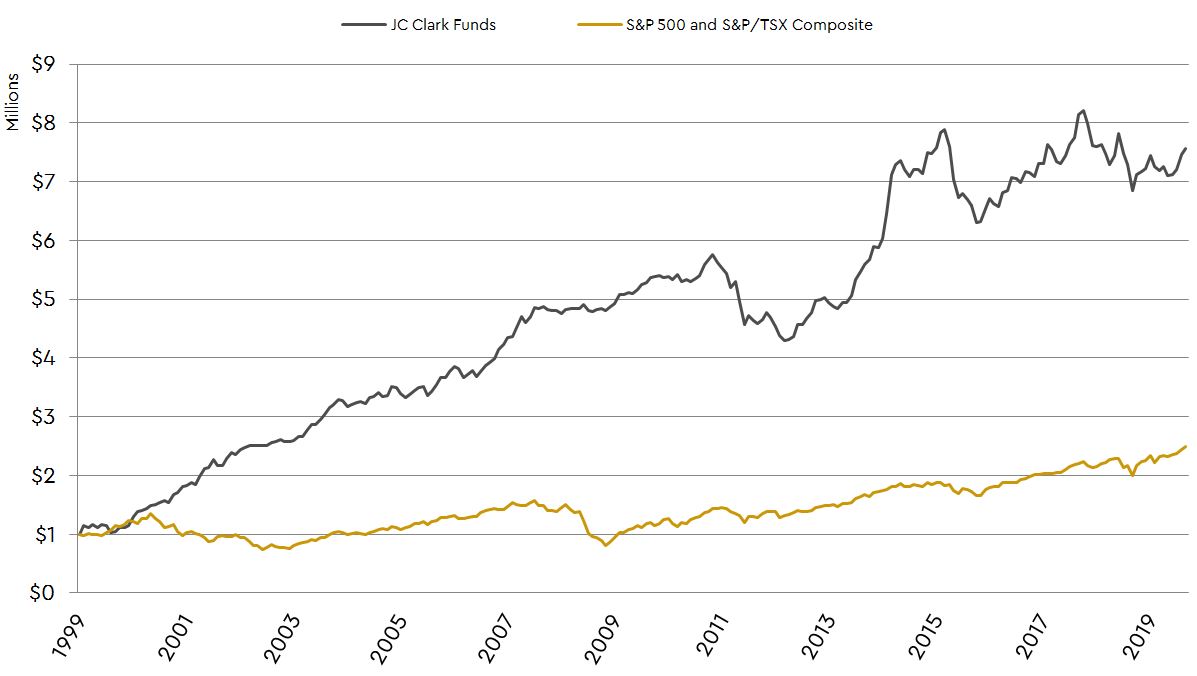

Our Flagship Funds, the JC Clark Preservation Trust and the JC Clark Opportunity Trust each have a 24 year track record with annualized returns of 8.26% and 10.77% respectively.

$1 million invested in the JC Clark Flagship Funds at inception (1999) would be worth $11.8 million today vs. $3.8 million invested in the market.